BlackRock Science and Technology Trust Faces Market Challenges

April 5, 2025 - 02:06

The BlackRock Science and Technology Trust, a closed-end fund (CEF) focused on technology investments, is currently navigating a turbulent market landscape. As tech stocks experience significant volatility and elevated valuations, the fund is under considerable pressure. Investors are closely monitoring the performance of technology shares, which have been impacted by various economic factors, including interest rate hikes and inflation concerns.

Despite the challenges, the fund aims to capitalize on growth opportunities within the technology sector. However, the prevailing market conditions have raised questions about the sustainability of high valuations and the potential for future returns. The trust's management is tasked with making strategic decisions to adapt to the shifting environment, ensuring that it remains resilient in the face of adversity.

As the technology market continues to evolve, stakeholders are keen to see how the BlackRock Science and Technology Trust will respond to these pressures and whether it can deliver value to its investors in the long run.

MORE NEWS

February 3, 2026 - 13:55

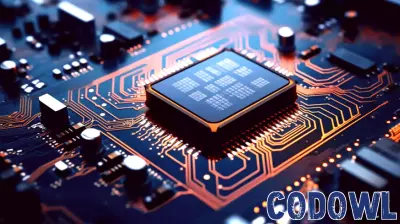

SoftBank subsidiary to work with Intel on next-gen memory for AIA strategic partnership has been announced between Intel Corporation and a subsidiary of SoftBank Group, aiming to accelerate the commercialization of cutting-edge memory solutions specifically...

February 2, 2026 - 21:25

Disability studies professor explores 'double bind' of medical technology in new bookMedical technology is often viewed as a neutral tool for healing or curing; however, for many disabled people, it represents a complex power dynamic between their own lived experiences and clinical...

February 2, 2026 - 03:07

Mizuho lifts Micron Technology, Inc. (MU)’s price target to $480, maintains outperform ratingInvestment firm Mizuho Securities has significantly increased its price target for Micron Technology, Inc. (MU), expressing strong confidence in the memory chipmaker`s financial trajectory. The...

February 1, 2026 - 03:04

A $1,000 Seed in Micron 42 Years Ago Would Have Blossomed into a FortuneThe staggering returns from early investments in technology titans are coming into focus, with Micron Technology serving as a prime example. A modest investment made decades ago would have yielded...